idaho inheritance tax rate

For more details on Idaho estate tax requirements for deaths before Jan. The state income tax rates for the 2021 tax year range from 20 to 60 and the sales tax rate is 445.

Idaho Estate Tax Everything You Need To Know Smartasset

Estate Trust Tax Services.

. For more details on Idaho estate tax. All Major Categories Covered. Inheritance tax rates differ by the state.

The tax rate ranges from 116 to 12 for 2022. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. These states have an inheritance tax.

That is not to say that some basic tax. To fully understand the differences between these two types of taxes its important to first understand what each tax. The state income tax rates range from 0 to 7 and the sales tax rate is 6.

Keep in mind that if you inherit property from another state that state may have an estate tax that applies. Idaho does not levy an inheritance tax or an estate tax. The top estate tax rate is 16 percent exemption threshold.

However more-distant family members like cousins get no exemption and pay an initial rate of 15. The state of Idaho requires you to pay taxes whether you are a resident or a nonresident who receives income from an Idaho source. This increases to 3 million in 2020 Mississippi.

The Illinois estate tax rate is graduated. Idahos capital gains deduction. Idaho has no state inheritance or estate tax.

It starts at 8 and goes up to 16 at the high end. The estate tax rate is based on the value of the decedents entire taxable estate. Idaho Inheritance and Gift Tax.

Idaho does not levy an inheritance tax or an estate tax. To ensure a successful plan we at Idaho Estate Planning will. Call us toll free at 8772326101 or 2082326101 for a consultation with the Racine Olson team.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. The Pelican State offers tax deductions and credits to reduce your tax li. Learn How EY Can Help.

Learn about Idaho tax rates for income property sales tax and more to estimate your 2021 taxes. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate. However like all other states it has its own inheritance laws including the ones that cover what happens if the decedent dies.

Inheritances that fall below these exemption amounts arent subject to the tax. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only. Does Illinois have an estate tax exemption.

Idaho state sales tax rate. In 2022 Connecticut estate taxes will range from 116 to 12. 1 educate you and.

The Illinois estate tax exemption is 4. There is no federal inheritance tax but there is a federal estate tax. As of 2021 the six states that charge an inheritance tax are.

Estate Trust Tax Services. Select Popular Legal Forms Packages of Any Category. When the deceased person.

We will answer your questions and will. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. As of 2004 the state of Idaho expired its estate and inheritance taxes.

A decedents heirs are entitled to inherit her estate according to Idaho statute 15-2-101 when she dies without a will. Idaho state tax rates Idaho state income tax rate. Idaho also does not have an inheritance tax.

No estate tax or. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Differences Between Inheritance and Estate Taxes.

Section 15-2-102 permits a surviving spouse to inherit the. Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property. Inheritance tax usually applies in two cases.

Understanding the complexities of Tax Planning is just a part of successful estate planning. Idaho state income tax rates range from 0 to 65. No estate tax or inheritance tax.

Learn How EY Can Help. Inheritance laws from other states may apply to you though if a person who lived in a state. As of 2015 each individual can pass up to 543M or each married couple can pass upto 1068M before being subject to Estate Tax.

Estates and Taxes. Starting in 2023 it will be a 12 fixed rate. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Connecticuts estate tax will have a flat rate of 12 percent by 2023. State income tax rates range from 0.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

In Idaho 40 0 Percent Of Trump S Proposed Tax Cuts Go To People Making More Than 1 Million Itep

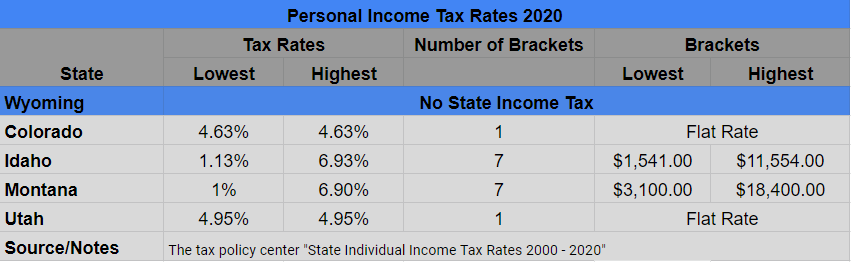

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

How The House Tax Proposal Would Affect Idaho Residents Federal Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Idaho Inheritance Laws What You Should Know

Idaho Estate Tax Everything You Need To Know Smartasset

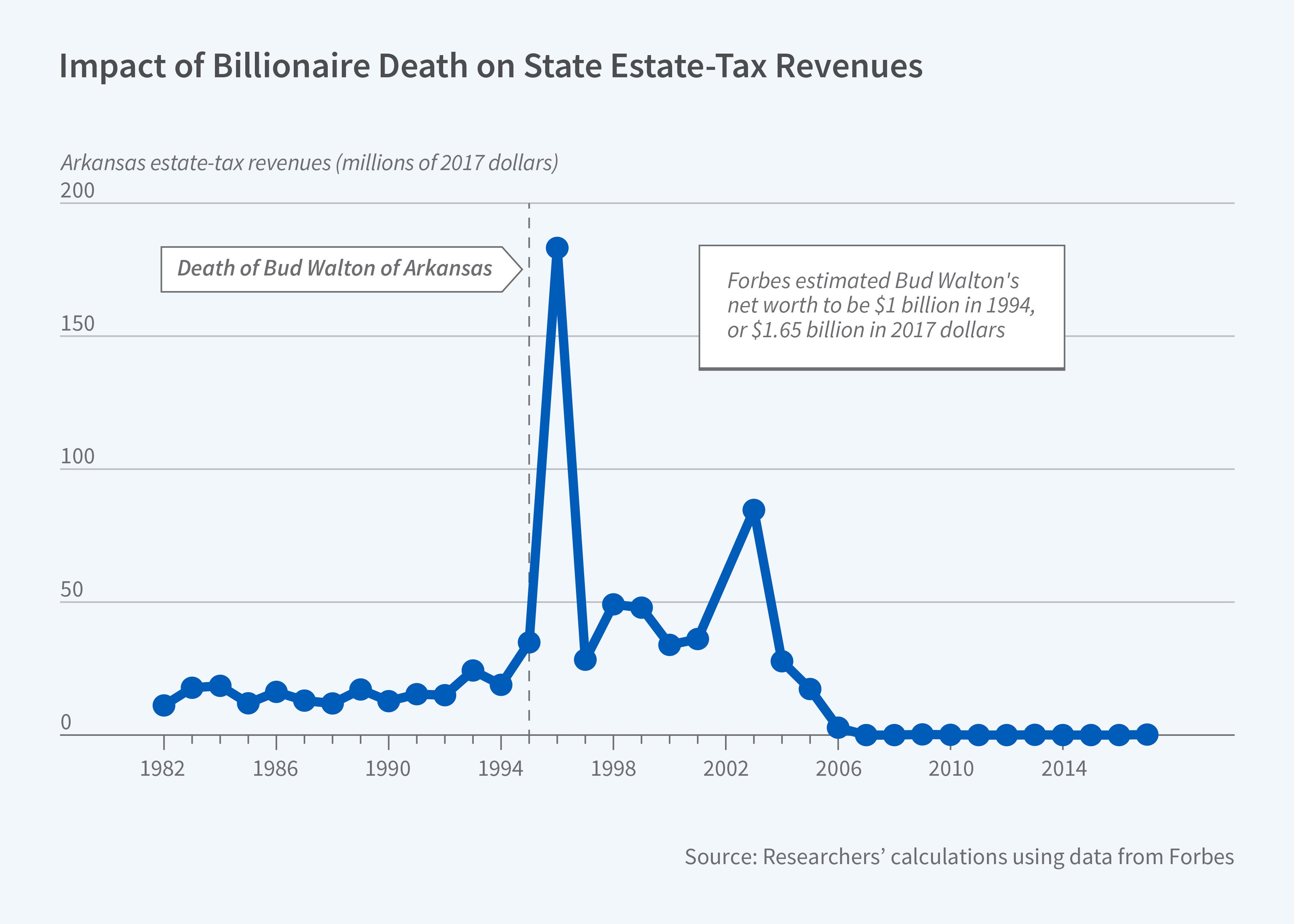

State Level Estate Taxes Spur Some Billionaires To Move Nber

Historical Idaho Tax Policy Information Ballotpedia

Estate Tax Rates Forms For 2022 State By State Table

4 Things You Need To Know About Inheritance And Estate Taxes

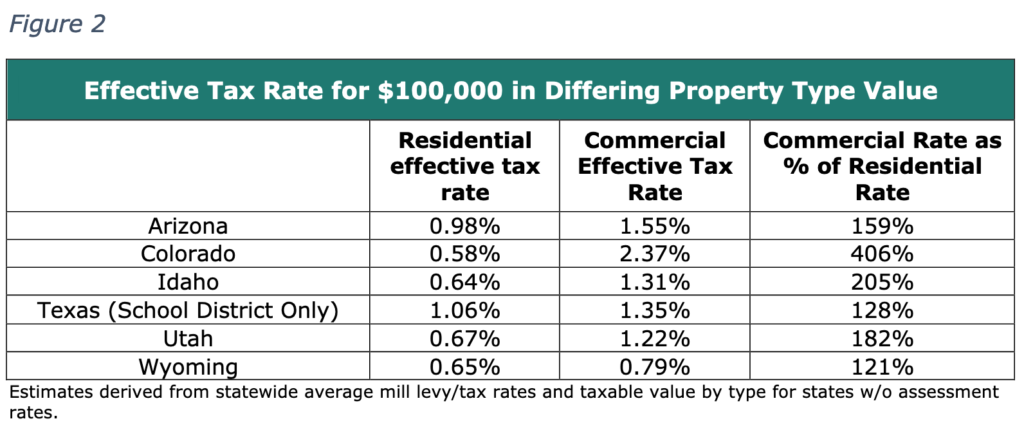

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Idaho Health Legal And End Of Life Resources Everplans

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Idaho State 2022 Taxes Forbes Advisor

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation